I thought this to be an opportune time to cover Double Three Combination Corrections (there may be a need to brush up on this type of correction very soon)

Double three's are some of the more complex corrections, but if caught early can offer insight to the unfolding wave count and allow one to be in a position to capitalise on the break out. They are usually rare on the larger time scales, but having knowledge of these structures will be useful for when they do occur.

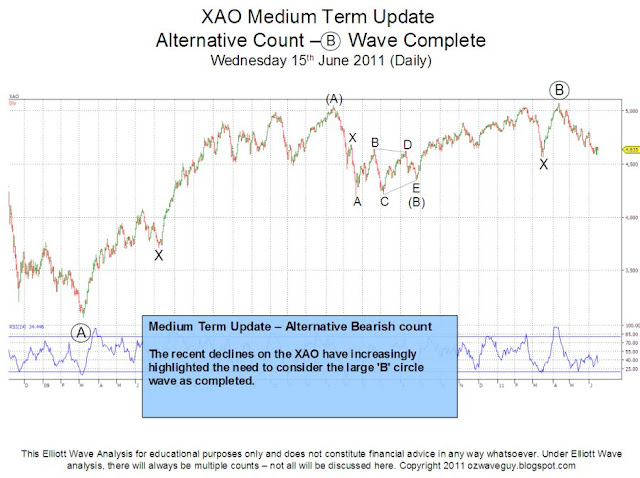

Below is an example of a Double Three on the XAO taking over a month to complete. Without the labels, it can be a little difficult to see. The give away is a long sideways move that consistently moves in waves of 3. Initial interpretations may be a triangle, however, the expected end and break out of the triangle doesn't appear as one expects - leading to several re-evaluations of the wave count.

With the Labels added, the double three is clear. There's even a Fibonacci relationship between the waves - although it's not guaranteed every time. A confusing factor in this example was a triangle for wave 'b' '(b)' in the 'c' leg of the Triangle itself.

The larger picture shows the Double Three is the b wave in a zig-zag correction. This whole structure was the A wave in a triangle that formed over several months.